Tax planning is a focal part of Financial Planning. Taxes can eat up a sizeable portion of your income. With a proper Tax planning you can save your taxes in many ways. A taxpayer can avail various deduction, exemption & benefits through different investments to reduce the Tax Liability.

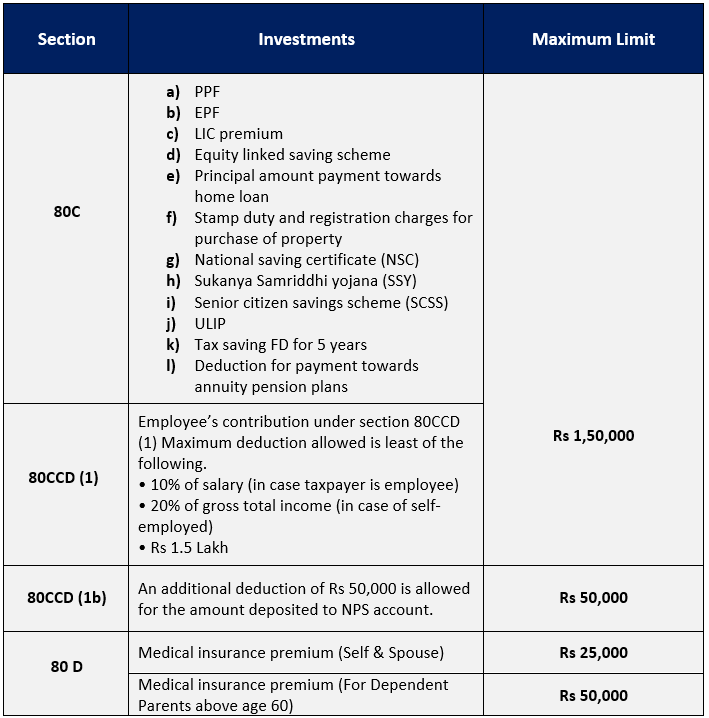

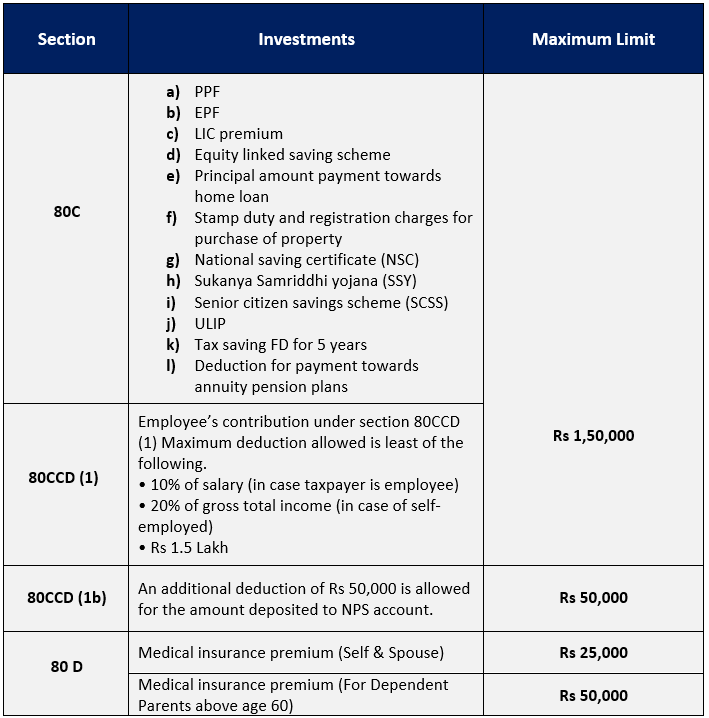

Various Section and Deductions

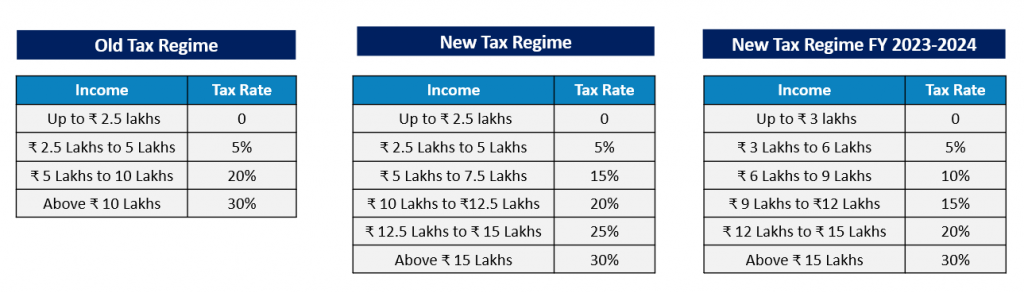

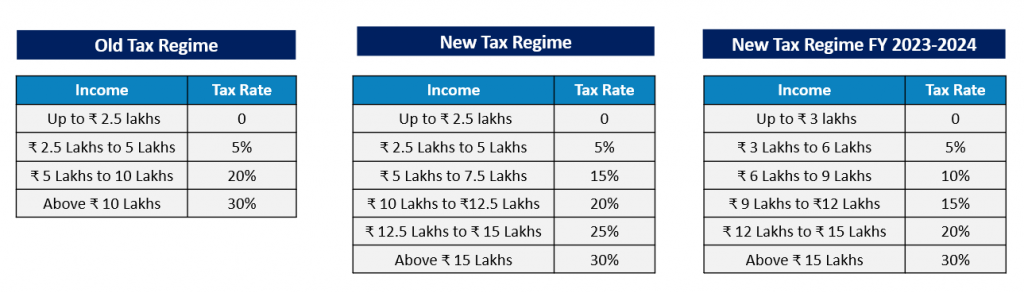

Tax as per New & Old Regime

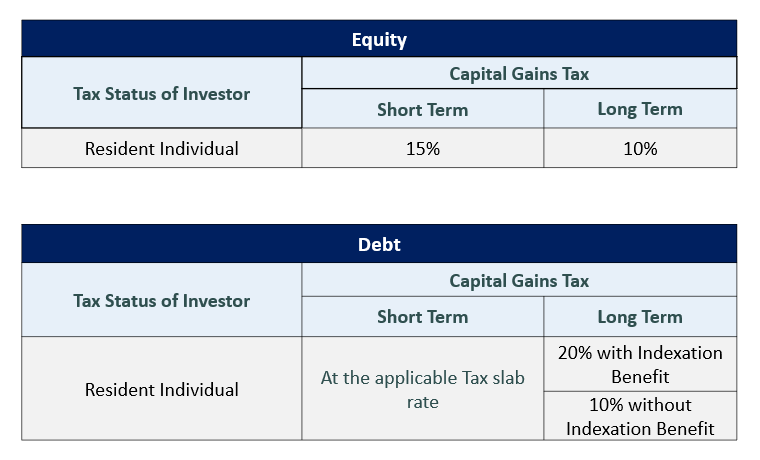

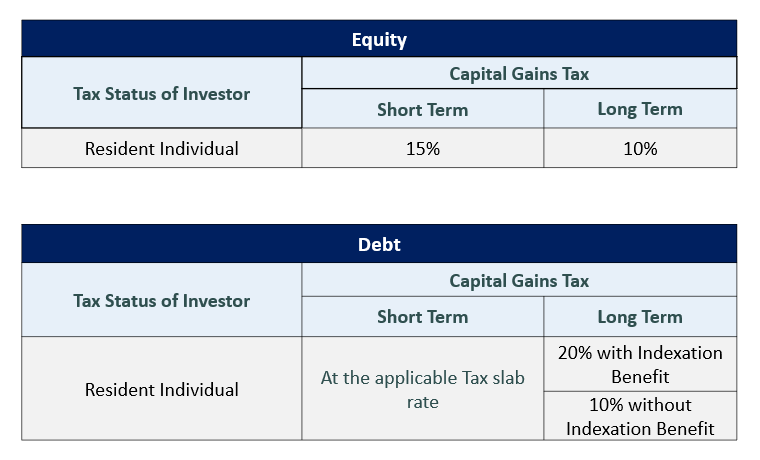

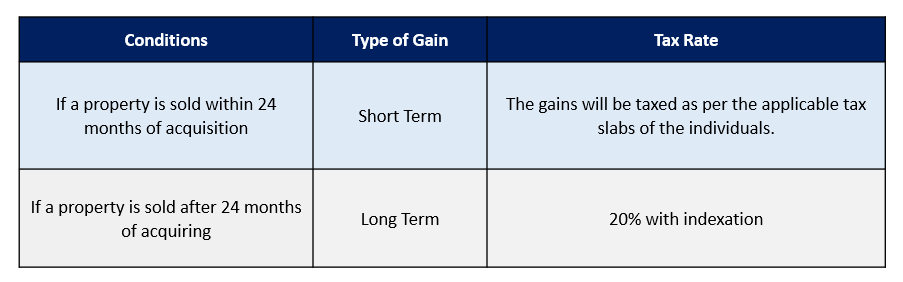

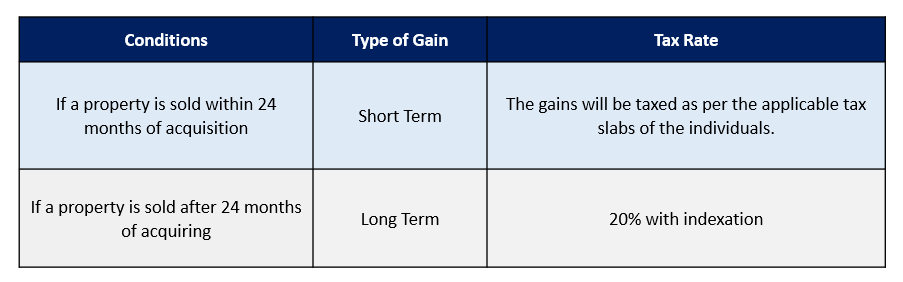

Taxation on Capital Gains

Indexation

Indexation is used to adjust the purchase price of an investment to reflect the effect of inflation on it.

In case of Mutual Funds

Let’s say you invested in a debt fund in Jan 2019. Your investment amount was Rs.1,00,000. Four years later, you redeem your investments in Feb 2023 the value of your investments was Rs.1,50,000. Your investment made capital gains worth Rs.50,000.

However, you need not pay tax on this entire amount of Rs.50,000. As your holding period was 4 years, you will get the benefit of indexation to reduce the value of your long-term capital gains. To arrive at the Indexed Cost of Acquisition (ICoA), you have to use the following formula:

ICoA = Original cost of acquisition * (CII of the year of sale/CII of year of purchase)

In the example mentioned above, the indexed cost of acquisition will be Rs.1,18,214 i.e.,(1,00,000 * 331/280).

Hence, instead of Rs.50,000, your capital gains will now be Rs.31,785, i.e. (Rs.1,50,000 – Rs.1,18,214).

In case of Real Estate

Mr. X sells a residential property for Rs. 1 Crore in March 2018. The property was acquired in April 2005 for Rs. 25 Lakh. Assuming no renovation was done on it, the indexed cost of that house in 2018 would be Rs. 58,11,970 resulting in a capital gain of Rs. 41,88,030.

To avail Tax Exemption under capital gain tax on property one must meet the following conditions.

1. Capital gains generated from sale of property needs to be invested in capital gain bonds like National Highway Authority of India (NHAI) and Rural Electrification Corporation (REC)

2. The amount cannot exceed more than 50Lakhs in in capital gains bonds.

3. The investment needs to take place before filling tax for that Financial Year or within six months from the date of sale.

4. The investment amount can be redeemed only after 5 years.